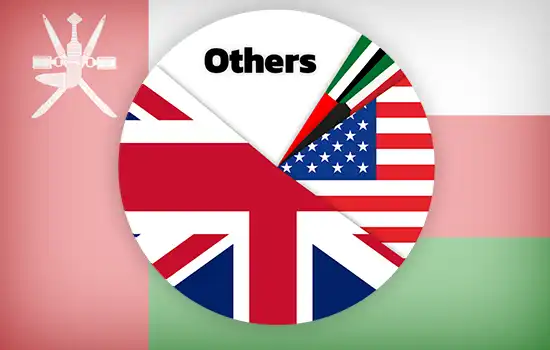

UK Leads, US and UAE Follow as Top Foreign Investors in Oman in 2024

According to a newly released report, Oman successfully attracted RO3.715bn (approximately $9.6bn) in foreign direct investment (FDI) during the first nine months of 2024.

These investments, primarily concentrated in the oil and gas and manufacturing sectors, highlight Oman’s increasing appeal to international investors and its growing position as a stable destination for global capital.

FDI Performance and Growth

- Total FDI Stock: Reached RO26.677bn (around $69bn) by the end of September 2024, reflecting a 16.2% year-on-year increase compared to RO22.961bn (approximately $59.4bn) in the same period last year.

- FDI Inflows (January–September 2024): Totalled RO3.715bn (around $9.6bn), lower than the RO4.821bn (approximately $12.8bn) recorded during the same period in 2023.

| Indicator | Amount (RO) | Approximate (USD) | Year-on-Year Change |

|---|---|---|---|

| Total FDI | 26.677 billion | $69 billion | 16.2% increase |

| FDI Inflows (2024) | 3.715 billion | $9.6 billion | Decline from 2023 |

Sectoral Distribution of FDI

- Oil and Gas:

- Share of total FDI: 79.1% (RO21.112bn, around $54.6bn).

- New investments: RO3.439bn (around $8.9bn).

- Manufacturing:

- Share of total FDI: 8% (RO2.137bn, approximately $5.5bn).

- New investments: RO730.3mn (around $1.89bn).

- Financial Brokerage:

- Share of total FDI: 5.1% (RO1.364bn, around $3.5bn).

- Real Estate and Rental Activities:

- Share of total FDI: 3.6% (RO969.1mn, approximately $2.5bn).

| Sector | Amount (RO) | % of Total | Approximate (USD) |

|---|---|---|---|

| Oil and Gas | 21.112 billion | 79.1% | $54.6 billion |

| Manufacturing | 2.137 billion | 8% | $5.5 billion |

| Financial Brokerage | 1.364 billion | 5.1% | $3.5 billion |

| Real Estate and Rental | 969.1 million | 3.6% | $2.5 billion |

| Transport and Communications | 379.5 million | 1.4% | $1 billion |

| Electricity and Water | 323.2 million | 1.2% | $0.84 billion |

| Trade | 214.9 million | 0.8% | $0.56 billion |

| Hotels and Restaurants | 107.9 million | 0.4% | $0.28 billion |

| Construction | 13 million | 0.05% | $33.8 million |

| Other Activities | 56.6 million | 0.2% | $147 million |

Top Foreign Investors

- United Kingdom:

- Largest investor, holding 51.2% of total FDI stock (RO13.665bn, around $35.1bn).

- United States:

- Investments: RO5.253bn (approximately $13.5bn).

- United Arab Emirates and Kuwait:

- UAE: RO836.5mn (around $2.15bn).

- Kuwait: RO833.5mn (around $2.14bn).

- Other Significant Investors:

- China: RO817.8mn (around $2.1bn).

- Switzerland: RO551.9mn (around $1.42bn).

- Qatar: RO488.3mn (around $1.25bn).

| Country | FDI Amount (RO) | % of Total | Approximate (USD) |

|---|---|---|---|

| United Kingdom | 13.665 billion | 51.2% | $35.1 billion |

| United States | 5.253 billion | 19.7% | $13.5 billion |

| UAE | 836.5 million | 3.1% | $2.15 billion |

| Kuwait | 833.5 million | 3.1% | $2.14 billion |

| China | 817.8 million | 3% | $2.1 billion |

| Switzerland | 551.9 million | 2.1% | $1.42 billion |

| Qatar | 488.3 million | 1.8% | $1.25 billion |

| Bahrain | 375.7 million | 1.4% | $0.98 billion |

| Other Countries | 3.2 billion | 12% | $8.2 billion |

Conclusion

Oman’s ability to attract and sustain FDI highlights its growing competitiveness and appeal on the global stage. Investments in oil and gas and manufacturing sectors continue to dominate, while emerging opportunities in real estate, transportation, and financial services pave the way for diversified growth.

Source:

This news has been sourced from Muscat Daily. For more details, please access the link below.

Oman attracts RO3.7bn in foreign direct investment till Sept 2024 – Muscat Daily